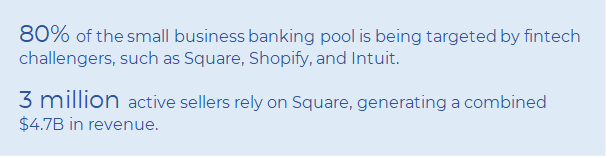

- 80% of the small business banking pool is being targeted by fintech challengers, such as Square, Shopify, and Intuit. These companies have expanded by offering solutions aligned to the financial needs of small and medium-sized businesses.

- To counter this growing threat, financial institutions must adopt a similar strategy. For the majority of FIs, this path could be shortened through partnerships with SMB-focused fintechs.

In an age of megabanks, smaller regional and community FIs must now contend with another outsize threat: the platform giants.

According to Celent, third-party “platform giants” — companies like Square, Stripe, Shopify, and Intuit — have become much more aggressive as they target at least 80% of the small business banking revenue pools. At stake is a $370 billion opportunity to provide accounting and payments services to small businesses, based on one estimate by Cornerstone Advisors.

Of course, the aforementioned tech players did not become giants overnight. Many of them are following a methodical growth strategy, described by Celent as a “growth through adjacencies” model. That is, these companies have expanded by continually introducing new products and services carefully aligned to the financial needs of their core customer base — small and medium-sized businesses.

Square now offers many of the same products and services that a bank would

Square, as the ideal case study, now offers many of the same products and services that a bank would — including the crucial deposit accounts that make it even easier for customers to stay in their ecosystem. To overcome any remaining barriers, Square has now become a fully-chartered bank. Lest we forget, this is the same company that just ten years ago entered the SMB market with its humble dongle, designed to allow micro-merchants to easily accept card payments.

Small businesses, for their part, have become receptive to the many solutions now easily available to them. And clearly, they are willing to pay to find relief, whether to streamline existing processes or find better ways to manage finances. And as they add on more services with a few clicks of a button, their own FIs become less relevant to their day-to-day needs. As a result, SMBs are slowly but surely leaving their banks and credit unions behind.

Smaller regional banks and community FIs can become a viable option once again. Customer acquisition can begin now — but it must be based on a digital, solutions-first strategy. With the right technology, community and regional FIs can expand their market by better serving the needs of their small businesses.

Autobooks has focused on a problem plaguing SMBs: the ability to get paid

This is where Autobooks (link to white paper hosted on the Autobooks website. Link TBD)

comes in. Like the Square dongle of yesteryear that solved a clear problem for merchants — and then opened a path for future growth — Autobooks has focused on a problem plaguing small businesses today: getting paid online.

Because Autobooks is integrated into an FI’s digital banking platform, a small business can simply log in and send an online invoice right from their banking app. A customer can pay in any number of ways, including by credit card.

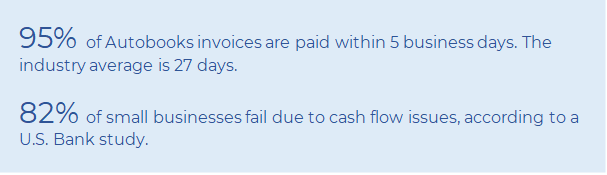

This much-needed invoicing tool has become a game changer. Now businesses can easily send an invoice and get paid in a matter of days — ensuring a steady flow of operating funds. In their research, Autobooks recently uncovered an encouraging trend: 95% of SMBs who rely on their invoicing tool are paid within five business days. This is in stark contrast to the industry average: a dismal 27 days.

Small businesses in the U.S. have a cash flow problem

The importance of getting paid — and promptly — cannot be overstated. A recent U.S. Bank study found that the reason small businesses fail overwhelmingly has to do with critical cash flow issues. As a matter of fact, a staggering 82% of SMBs fail for this very reason.

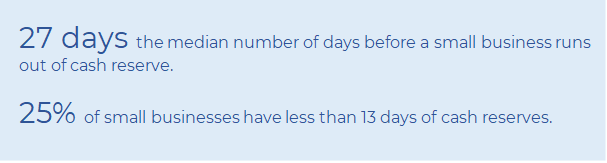

To a casual observer, this 22-day difference may not seem like such a big deal. However, to the business owner, even a few days without access to funds could spell doom for their business. After all, most small businesses only have enough cash to last them 27 days. And 25% of small businesses have less than 13 days of cash reserves.

It’s no wonder then that small businesses have turned to fintech challengers for relief. But for every small business that turns to an outside payments solution, there is a potential to never see that resultant deposit at the FI.

Here’s why: challenger platforms make it easy for users to keep funds within their ecosystem with easy-to-access deposit accounts and virtual wallets, and very difficult to transfer to external FIs with artificial delays and added fees. Over time, this disintermediation can make the FI almost unnecessary to an SMB’s day-to-day financial processes.

A clear win-win for both the FI and the small business

With Autobooks, an FI is guaranteed that all payments are deposited into an SMB’s business checking account. Indeed, there is no need for a business owner to rely on an outside platform for receivables — these critical transactions are handled natively within the FI’s digital channels. The FI is able to monetize on those payments and see growth in SMB deposits.

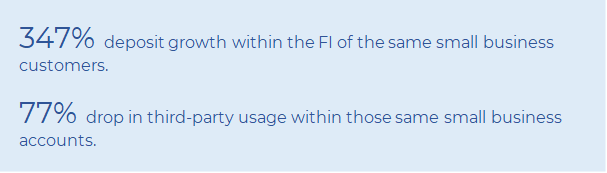

After analyzing at a partnering FI’s data, Autobooks discovered that there was a 347% growth in deposits within the same pool of small business users. On the other hand, third-party usage decreased by 77% within those same business users. This last figure is a clear indicator of a crucial FI goal: primacy. By making the third-party challenger superfluous to the needs of their small business customers, this FI established primary institution status.

And just as significantly for the FI, this aforementioned shift happened over the course of just nine months. In other word, in less than a year, Autobooks helped their partnering FI reclaim the majority of deposits being lost to external, third-party challengers.

To learn more about how your financial institution can better serve and monetize small businesses, read our new Autobooks Guide to ROI, available now.

Powered by: