How we help your financial institution stay ahead of the competition

|

In this sixth and final session of Autobooks ACCELERATE, Derik Sutton discusses specific ways that Autobooks helps small businesses accept digital payments and manage cash flow, and how this functionality allows your financial institution to better support these customers while staying ahead of third-party competition. |

Download the recordings and various resources from ACCELERATE 2022 and make an immediate impact on your financial institution.

Download the recordings and various resources from ACCELERATE 2022 and make an immediate impact on your financial institution.

The following conversation was edited for clarity and brevity.

Business customer needs are changing

Derik Sutton: One of the things that we talk about here at Autobooks is that we work hard to help small business get paid — and your financial institution stay ahead of the competition.

You may ask, how do we help small businesses get paid? First, we talk with businesses regularly. We also just call out to them from a research perspective to understand their needs. Secondly, we apply those learning to our products. And thirdly, we then build out marketing assets that you can use at your financial institution to engage, educate, and hopefully activate your customers.

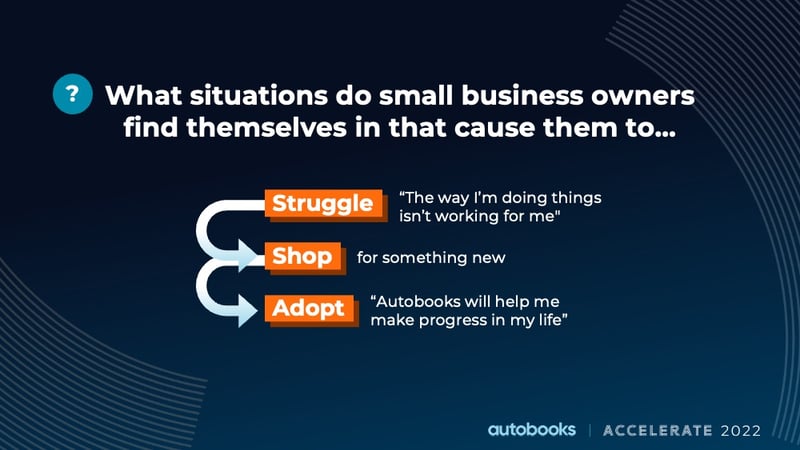

And so when we're talking to these businesses, what we're specifically trying to understand are their struggles and their needs, related to the way they are doing things currently.

We often hear stories like, “I was collecting checks for my customers, but that started to fall apart. Some people used to pay me with wires, and now they want to pay with a card.” Another one: “I used to use PayPal. But the first time I did a large transaction, they held my funds for six weeks, and that created cash flow problems for me.”

So we're paying attention to those struggling moments, so that we can understand how we can help. We want to know what then causes these businesses to shop. Why are they then looking for something different? How do they shop those alternatives? What sources are they looking at? What keywords do they have in their mind? What are they saying to themselves?

The importance of customer interviews

Derik Sutton: Ultimately, what we want to learn is how can we best build out our product in a way that would cause these owners to adopt the Autobooks solution to get paid, versus, you know, using a third-party tool.

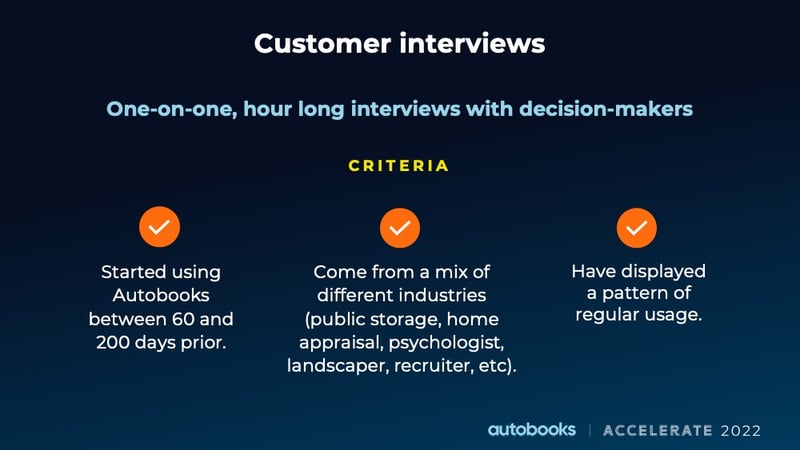

And so we do that by setting up one-hour long interviews with our customers [see our Day One session for more on our Jobs to be Done framework]. We conduct these interviews monthly. When we started off as a company, we did a whole bunch at the beginning. Now we continue to conduct these calls monthly, so that we can continue to stay in touch with our users.

Users come from a mix of backgrounds. We don't just focus on one segment; we try to cross over all the segments, and we want to talk to people that have a regular pattern of usage with our app.

A brief overview of the four customer jobs

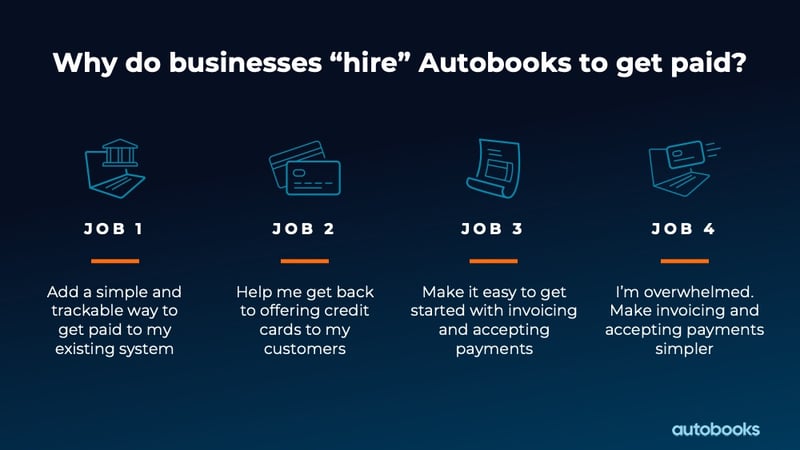

Derik Sutton: And this is what we’ve uncovered: there are four reasons why businesses hire Autobooks — all of them related to getting paid.

So think about this information as marketers and as sales reps. Think about the ways that you currently position your products and services, then ask yourselves: how can these insights better inform how we talk about small business, about checking, about treasury management, and so on? Let’s jump into them, briefly...

Job one: You've got people who need a simple and trackable way to get paid to their existing system. These are people who are saying, “Hey, I just need an invoicing tool or a payment acceptance tool through my bank. I don't need you to worry about how it fits into my ERP system or my accounting system, because I have a third-party bookkeeper for my business. I don't need it to be complicated. I just want to simply request money from people, have them pay me, and have it land in my bank account.”

Internally, we call that job one. So now think about your small business checking product page, online. Be sure to add something that speaks to digital invoicing and payment acceptance — that can be something as simple and easy as a bullet point.

Job two: “Help me get back to offering credit cards to my customers.” These are people that maybe use PayPal, Square, or some other third-party provider, or still use them, but there is some degree of distrust. Maybe they had a bad customer service experience, like the third party held their funds, and they're very leery now, and they've either kind of abandoned it all together and gone back to less efficient ways, or they’re eagerly waiting for their financial institution to offer a solution because they want to get away from that Silicon Valley app. And so when you as an institution offer a competing product and demonstrate its capabilities, they become eager to partner with their financial institution.

Job three: These are people starting new businesses and or opening new accounts at your financial institution, and they're just saying, “Hey, make it easy for me to get started with invoicing and getting paid.” Or they might say something like, “I just started a business, and my mentor advised me to open a dedicated business account. But I didn't even think about how I’m going to get paid by my customers... Oh, great, you’ve got an integrated way to just send an invoice and get paid, or even send a secure link? That's perfect. That's exactly what I needed.”

They don't have to go shop for anything else. They can just adopt it right through your institution. So think about your new account kits, your new account welcome emails and calls and things of that nature that we just discussed. It’s a great time to ask them, “Hey, how do you get paid as a business?” And it may be that they're a traditional retailer, and you could sell merchant services, or it could be that they, you know, need traditional ACH batch or wire capabilities, great. We just want them to get paid through you! If we can be the tool that they need, that's awesome. Have them use our tool. if it's another tool they need, that’s great too.

Job four: “I'm overwhelmed. Make invoicing and payment acceptance simple and easy.” So think about the people that are in that scrambling moment. Either it was caused by their customer, or their internal solution just let them down, “The person that used to run and manage our system left, and I don't know how they used to do it.” So they're kind of overwhelmed. That's really kind of that moment of need, where you can respond with, “Hey, we've got the tools and capabilities. What do you need? How can we help?” And then, being there for them in a timely fashion — that pulls them right in and gets them going.

How third-party competitors excel at positioning products and services

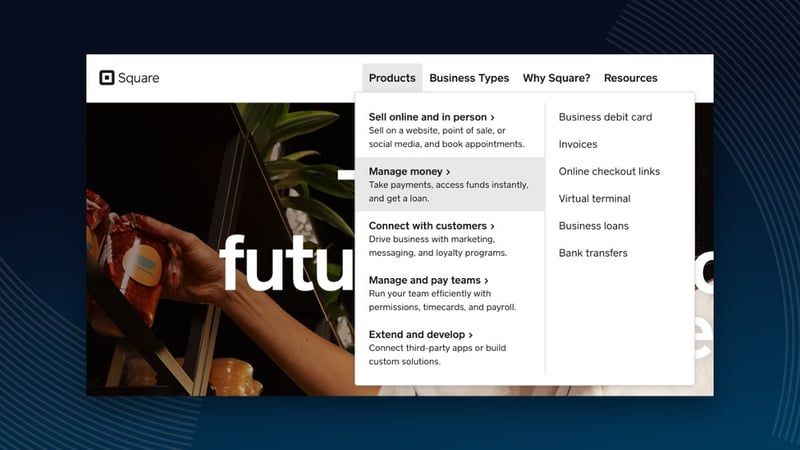

Derik Sutton: Ultimately, we want to work with your financial institution to help you stay ahead of the competition. When I talk about the competition, I like to dig into how exactly they go about communicating with prospects. For example, take Square. They’re a bank, and clearly a competitor. Anytime you see a Square transaction coming in, you need to think: “Dang it! One of my competitors has ahold of one of my customers. What can I do about it?”

I think it's good to always evaluate the competition. So now, as a marketer or a sales leader, you're not just comparing yourself against the financial institutions in your market, right? It’s no longer just banks and credit unions. You need to look at Square, PayPal, and others. And more specifically, you need to look at the way they talk about their products and services online, and then compare them to your checking accounts. Compare them to your treasury management pages, your business management pages, and your online presence in general. Just ask yourself, “Hey, if somebody were to look at these two web pages side by side, how would we stack up? Are we relatable? Do we convey what we do as well as they do, and if not, what do we need to do about it?”

So now imagine I’m a business owner, and I’m browsing Square online. I’m looking at their offerings — and this is important — I'm not seeing things like ACH management, wire services, or positive pay. Instead, I'm seeing terms that are very relatable to me. Okay, I need to manage my money. I want to take payments, access funds instantly, and get a loan. Based on their easy-to-understand menu that appears under products, I can do that through invoicing, business debit cards, online checkout links, virtual terminals, and more.

Hopefully, you can see how this sort of simplicity can be appealing to a business owner. Go to Venmo.com, and you can clearly see that they’re pivoting to business and to helping users start a business profile and then accept Venmo payments in-app, online, or in-person — thus tapping into their active community of 83 million people.

So it’s just a very simple, easy way for the business owner to get started quickly. It’s not just words. These companies also really lean into consumer imagery, because they want people to see themselves in the story that they're trying to convey.

And then, lastly, it's even the big banks like Chase. They’re pushing aggressively into this space with their new Quick Accept feature that they're really promoting. They fully bundle this functionality into business checking at Chase. And so now, when you go look at their business checking pages online, they lead with messaging focused on the convenience of built-in card acceptance. It's the top feature that they talk about when it comes to business checking.

They don't talk about the number of items that you can process, or easy access to online and mobile banking, or a debit card. All of that's table stakes, right? They mention it later on, but they lead with, “How do you get paid?” And “Did you know you can get paid directly through a Chase business account?” They do the typical call-outs, like the 15-dollar monthly fee, but it's all with built-in card acceptance, Chase Quick Accept, because they know that’s a powerful differentiator for them in the market, and it's very appealing to the business customer.

A great user experience goes a long way

Derik Sutton: What does Autobooks do to help you stay ahead of these savvy competitors? Glad you asked! First, we try to develop compelling user experiences for the business owners. We want to make it to where your institution can compete against the Chases of the world, and Squares, and PayPal, as best we can.

For example, we hear business owners say, “I send out these invoices, but people still just want to send back a check or want to do something different. Can you just make it where they don't do that?” In response, we’ve added QR codes to printed invoices, so that people can actually just pay via a QR code if they happen to print their invoice. Also, QR codes are now available inside the Autobooks application. So now you've got businesses that say, “I'd like to be able to just have my own QR code. I want to use it in-app. I want to print it off on a business card. I want to print it off on something and put it in my store front.” They can do that now.

And then we announced recently, but more details coming, that we will be offering contactless payments. It’s going to be available to users inside of our app capabilities. So, as we are integrated to your digital banking partner, we're going to start to make this capability available. Soon, you’ll have businesses that can allow a customer to just walk up and tap a card or tap an NFC-enabled device, and get paid right inside of your mobile banking app, and have those funds get deposited directly into their account.

The Autobooks Hub

Derik Sutton: We're also making major updates to the Autobooks Hub. We’re giving you all more access to data about these businesses as well. So we’re going to help you do the thing that Square, PayPal, or Venmo can't do, which is blend the banking experience with our experience and use the data that we have at hand to help you better understand customer behavior.

For example, we see B to B Home Inspectors just enrolled, and their velocity limit was set at $1,000 per transaction. Do you the banker want to raise that limit? Or do you want to contact the customer and ask them about their business before you request the limit to be raised?

New marketing assets coming in 2023

Derik Sutton: Next, let’s discuss what we are building from a marketing perspective that you all can leverage, and have us deliver in many cases.

As you know, we do things based on customer research, which we make available to you. So we have our reports and resources focused on the four jobs of business customers. If you want to geek out on that research, you can find it online at our website.

We also provide emails and email templates. We provide you social media copy and templates, ad templates, sample landing pages for business, checking and more. We also bundle a lot of that free content into seasonal resource kits.

We’ve done some interesting things with these resources. You can use our kits and everything on their own, or you can kind of use them piecemeal. You can just take content blocks, messaging blocks the way we talk about things, and just integrate them into your marketing as you see fit. We also have a third party that will do a customized package for you. So, if you want our off-the-shelf resources branded to your financial institution, we can do that.

The thing that we wanted to unveil today and take you through is our new 2023 go-to-market calendar. So if you want to launch something quickly to your business customers, we're going to have a kit for you. You’re free to take some of this messaging and just infuse it into what you're doing. Maybe you want to do something specifically around tax time. And so we have a kit around that to inspire businesses.

And then we have what we call these ongoing activities and resource kits that you can deploy at any time, that really complement and go hand in hand with Autobooks. Hub: so as we see that actual data coming in the reactional email response. And things like that that you can leverage and use and automate are here. You can access all of this great content and more right now, at Autobooks.co/marketing.

How to reposition small business checking

Derik Sutton: Another neat thing we did is actually put together a business checking page, to serve as a model. We have financial institutions ask us, “How can Autobooks help us with business checking? How would you redesign our current pages?” As a result, we hired an expert to do it. Her name is April Dunford, and she's written a book called Obviously Awesome. She's a positioning expert. She works with tech companies and software companies all over the world to help them position their products. And we basically just said, “April, here's all this customer research. Here's all this information that we have. How would you position small business checking?”

Then we basically took her process, and all of that information. And we wrote a guide to small business checking. You can download that guide at Autobooks.co, and see everything that we did with April. It’s all in there. And then we also just built a sample small business checking page, based on April's process. It’s available online here. You can actually just go there to see this page and just read through it. Granted, it may not fit into the aesthetic that you’ve established with your website, but that’s not the intent. It’s a model based on actual research and positioning that’s meant to inspire — you can borrow and emulate as you see fit.

You may also like

-

Supporting Small Business | Events

The training resources you need to get your in-branch teams up to speed

-

Supporting Small Business

Introducing Autobooks Capital: Empowering Financial Institutions to Support SMBs' Working Capital Needs

-

Digital Banking | Payments | Supporting Small Business

How to Launch Tap to Pay on iPhone