It's Time to Rethink Business Checking

You Provide the Account, We'll Provide the Tech

Small business owners are increasingly looking for more than just a deposit account from their financial institution. They want a single place to manage their business finances, from getting paid to tracking expenses and understanding cash flow.

This shift presents a major opportunity. It’s time to rethink business checking and deliver the tools business owners want, right where they already bank.

Get the full conversation |

The Role of Business Checking Is Changing

First, let’s define the small business segment.

Small business by the numbers:

There are 97 million small businesses in need of banking and financial management tools

91% of them earn less than $1,000,000 annually

This growing segment of businesses is in transition. They’re moving away from cash and manual processes and toward digital tools that help them get paid, manage cash flow, track expenses, and monitor the overall financial health of their business.

For financial institutions, this shift presents a unique opportunity. It’s a chance to evolve beyond offering a traditional deposit account and instead provide a complete financial hub. One central place to manage their business, without relying on disconnected third-party apps.

The market is moving, but there’s still time to act. Now is the time to rethink business checking and focus on the small and micro businesses that need support the most.

And Good News: Business Owners Want These Tools From Their FI

Despite the rise of fintech apps, most small businesses would prefer to get their financial tools from a provider they already trust, like their bank or credit union.

Consider the following:

- 65% of small businesses use third-party tools only because their bank doesn’t offer the features they need

- When offered the ability to send invoices, accept payments, and track income directly inside digital banking, business owners are quick to adopt

- Many are even willing to pay for these features, especially when they save time, reduce reliance on spreadsheets, or replace other paid software

This isn’t just a service opportunity. It’s also a revenue opportunity.

Big Banks Are Taking Note

Major institutions have started rethinking how they package and position their business checking accounts.

- Chase Business Complete Checking® now includes built-in payment acceptance. Business owners can accept card and digital wallet payments without needing a separate merchant services contract

- U.S. Bank Business Essentials Checking offers flexible tiers that integrate payment tools, cash flow management, and accounting features

These examples reflect a broader shift. The business checking account is becoming a complete financial hub.

The good news is that your institution can offer the same experience, or even better. You don’t have to be a megabank to deliver value to small businesses.

You Provide the Account, We Provide the Tech

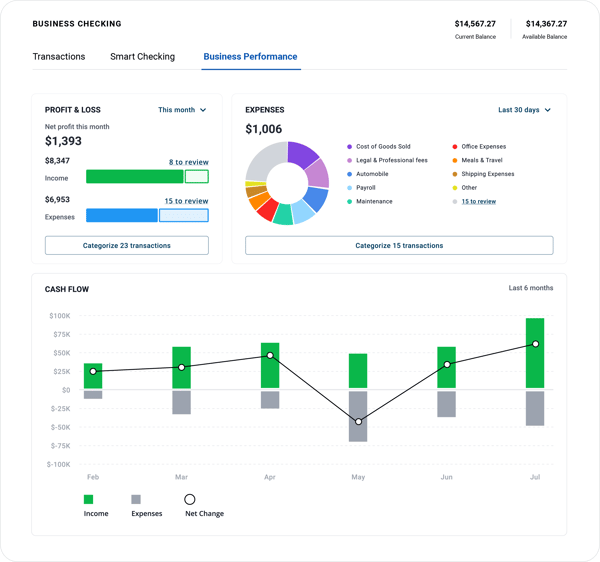

With Autobooks, your institution can launch a smarter small business checking account that includes:

- A small business dashboard inside digital banking

- Digital invoicing

- Online and in-person payment acceptance

- Integrated bookkeeping and categorization tools

- Real-time financial reporting

- Cash flow insights

These features are embedded directly inside your online and mobile banking platforms. This creates the kind of all-in-one financial hub business owners are looking for.

No third-party apps.

No external connections to manage.

No fragmentation of deposits or customer payments.

Just one platform, delivered through your institution.

Now Is the Time to Rethink Business Checking

For the 91% of small businesses earning under $1,000,000, traditional business checking accounts and cash management tools aren’t always the best fit. These businesses often go underserved by their financial institution. As a result, they turn to outside providers to meet their needs.

By offering a smarter small business checking account, your financial institution can:

- Increase product adoption and account primacy

- Deepen both new and existing customer relationships

- Compete with larger providers

- Drive non-interest income through value-added services

And with Autobooks, you don’t have to build this technology yourself. We’ve already done it.

You provide the account. We provide the tech.

Want to hear more? Book time with our team

You may also like

-

Transforming Digital

Rethinking Business Checking: Why It's Time for Banks to Modernize

-

Gaining Perspective

Three Takeaways from Our Latest Webinar: How Banks Can Win Small Business Relationships Back

-

Transforming Digital

From Tools to Transformation: Why Small Business Owners Need One Place to Manage It All