Helping small businesses "Get paid at a distance"

First and foremost, we want to start by saying that we recognize the tremendous effort that lies ahead for our country to deal with the Covid-19 pandemic, and the eventual recovery. It is our mission to start that recovery as soon as possible by proactively educating our current financial institution partners and the small businesses they serve. If you are not a current Autobooks client, we hope you find this information valuable and informative as you begin to help small businesses through this difficult time.

Summary of topics covered

- How the Autobooks solution can be counted on to offer support for small businesses that need to "get paid at a distance"

- Autobooks team response to help educate our current financial institutions and their small businesses.

How Autobooks helps small businesses "get paid at a distance"

Autobooks uses a product development framework called jobs-to-be-done (JTBD). The use of the JTBD framework helps us ensure that we always have the needs of the customer at the forefront when we are building new features, or enhancing new ones. We won’t take the time to go into an exhaustive explanation, but the below definition from Clayton Christensen, one of the frameworks founders, is perfect for the purpose of today.

“The jobs-to-be-done framework is a tool for evaluating the circumstances that arise in customers’ lives. Customers rarely make buying decisions around what the “average” customer in their category may do—but they often buy things because they find themselves with a problem they would like to solve. With an understanding of the “job” for which customers find themselves “hiring” a product or service, companies can more accurately develop and market products well-tailored to what customers are already trying to do.”

When our team completed our JTBD research in 2018, we uncovered the 4 Jobs of our solution. Essentially these are the four root causes as to why a small business owner would "hire" Autobooks for their small business.

-

- Job 1 – Add a simple and trackable way to get paid back to my existing system.

- Job 2 – I tried to offer credit card as form of payment from someone other than my financial institution and was burned. Help me get back to offering credit card to my customers, but from someone I trust.

- Job 3 – Help me get started with an easy way to send invoices and get paid by customers

- Job 4 - I’m overwhelmed, make invoicing and payments simpler so that I can keep things organized and manage the chaos.

Looking back on that research, it is reassuring to know that those underlying customer needs have been driving our product development over the past 18 months. We even had a phrase we used at the time that seems eerily significant to the environment we find ourselves in today. We kept saying “when a business owner needs to accept payment at a distance.” It was our way of saying that our product needed to satisfy the needs of a small business owner when the circumstances did not allow for the business owner or customer to be face to face.

Because of that, we feel confident that we are in a position to truly help business owners not only “get paid at a distance” for these coming months, but also through situations or events that may cause that need in the future.

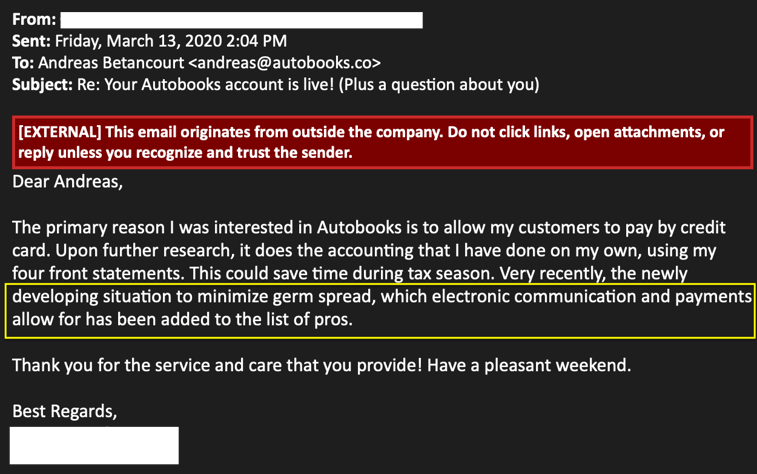

As validation to our belief that we can truly help, we have received feedback from small businesses directly and indirectly that recognize the benefit of being able to "get paid at a distance.”

In addition to inbound interest from small businesses at our partner financial institutions, we are seeing more and more small businesses use digital invoicing to request and receive payment, even those that are traditionally POS-based.

We have a tremendous opportunity to help small businesses by enabling them with business banking tools that do their "job" to help small business owner in their moment of need. This has been true before the recent pandemic, and is especially even more urgent today.

According to Alex Johnson, Director of Portfolio Marketing for FICO who was recently quoted in an article from Financial Brand , “Most of the time, consumers don’t think about banking at all. They just expect it to work. The only times they really think about banking is when there is financial need or when they're facing a crisis. Johnson continues, “Delivering solutions, tailored to each individual customer, is what builds trust and brand loyalty in these moments.”

The Autobooks team response

To help provide education and support to both small businesses and our financial institutions, the Autobooks team will provide the following services.

Education and onboarding of small business owners:

- Extended Demo Hours - Our team will be available 24/7 to assist small business onboard and Autobooks in order to collect payments.

- Extended Merchant Onboarding Hours - We recently made an enhancement to our onboarding process to support real-time merchant onboarding. However, there are circumstances that prevent realt-time enablement. For those circumstances we have extended our merchant onboarding hours to help ensure small businesses can sign up can and start accepting payments within three hours.

Education and support for our financial institution clients:

- We are holding a series of webinars focused on how to assist small business owners.

- Thursday March 19that 11am ET

- Thursday March 19th3pm ET

- Friday March 20that 11am ET

- Topics include

-

- Information about Autobooks’ extended hours and our plan to support financial institution needs.

- How to identify if a small business is facing challenges.

- How to help small businesses overcome challenges and get paid at a distance.

You may register to attend here.

You may also like

-

Transforming Digital | Growing Revenue | Supporting Small Business

Unlocking the Full Value of Small Business Banking: Introducing the New Autobooks Packages

-

Gaining Perspective

Third-party activity inside your financial institution: Looking at the data

-

Jobs-to-be-Done | Supporting Small Business

Part two: What do your small businesses want?