The State of Small Business Banking: Overview and Take-Aways from the Arizent Report

- Is your financial institution focused on supporting small businesses this year? If so, it may be helpful to better understand what small business owners are concerned about today and into the near future.

- In this post, we discuss and analyze a new report that we co-sponsored with Arizent/American Banker, The State of Small Business Banking.

- For the report, Arizent asked a cross-section of 358 small business respondents to discuss what matters most in their banking relationships — and more specifically, to describe the key challenges that they face today as well as their key priorities as they look to grow in the next twelve months.

In 2022, the number of small businesses in the U.S. surpassed 33 million, encompassing nearly all businesses (99.9%) in the country. This is a 2.2% increase from the previous year, despite an economy currently undergoing challenging conditions.

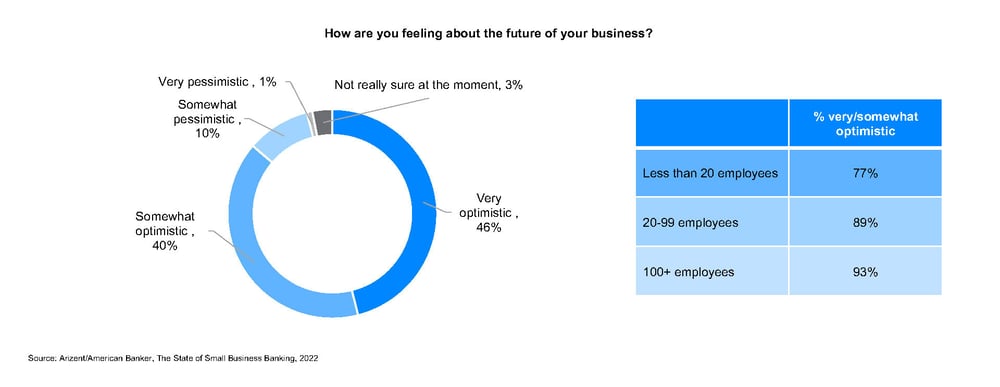

Clearly, there is no shortage of Americans who continue to pursue their dreams — transforming their passions and interests into new business ideas every day. And for the most part, they remain optimistic about the future. According to a recent report put together by Arizent/American Banker and sponsored by Autobooks, a whopping 86% of respondents felt either very optimistic or somewhat optimistic about the future of their businesses, with larger firms tending to score themselves higher.

If anything, this pervasive optimism reflects positively on small business owners: they will continue to charge ahead and seek opportunity, despite the challenges that might get in their way.

Take-Away:

Those financial institutions that are seeking a customer base with a good potential for deposit growth and relationship depth, even during challenging economic conditions, would do well to find relevant and cost-effective ways to service even more small businesses.

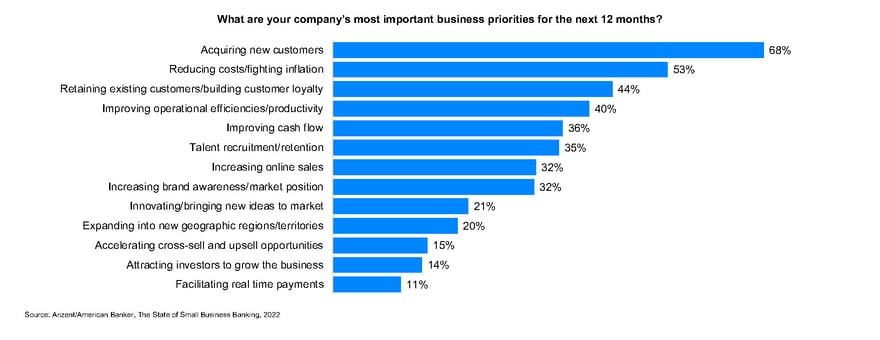

Nevertheless, cracks are beginning to show; more than half of business owners are most concerned with reducing costs and fighting inflation in 2023. However, no priority ranked higher than that of new customer acquisition — 68% of businesses rated it as their top priority for the coming year. If anything, this priority indicates a willingness for small businesses to double down on growth, even as they face a potential downturn. That, combined with the fact that they are also prioritizing customer retention (44%), represents moat-building at its best.

Worth noting is the fact that small businesses continue to prioritize cash flow; over one-third of them cited this priority for the coming year. Historically, cash flow management has been an ongoing preoccupation and pain point with small business owners. The lack of cash flow is often cited in studies as one of the top reasons why small businesses fail.

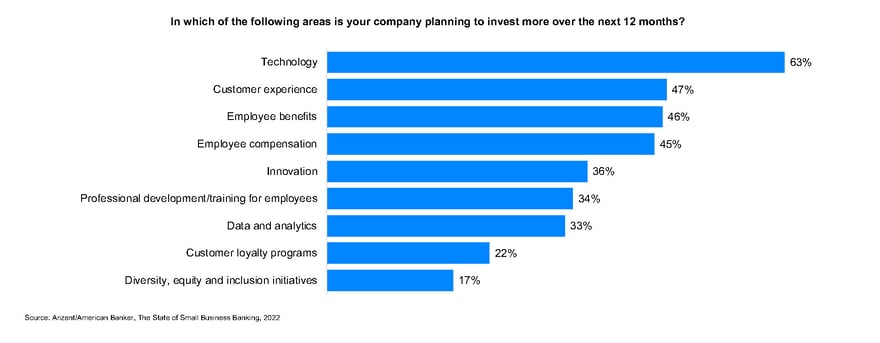

Perhaps related to the aforementioned priorities, 63% of small businesses are looking to invest in technology, and almost half will invest in ways to improve the customer experience. What do these emerging areas of investment signify for financial institutions looking to deepen existing relationships, even as they court new businesses?

Take-Away:

Savvy financial institutions should take the time to identify those priorities that best align with their core business offerings, and strive to position and promote their products as solutions to pressing needs and pain points.

Implications for small business-focused financial institutions

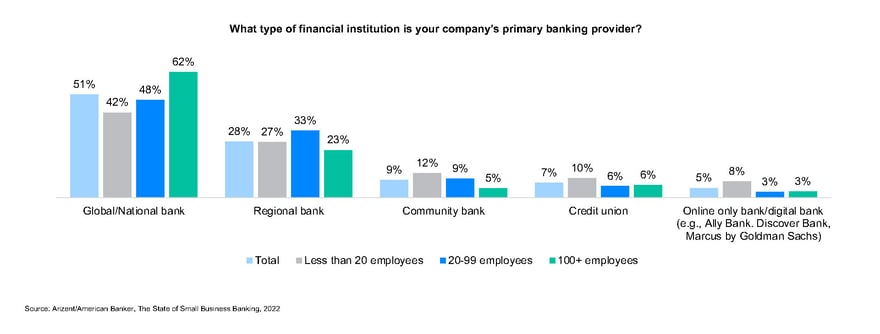

When it comes to choosing their financial institutions, small business owners seem to have a preference based on size. Global/national banks tend to attract small businesses with 100 or more employees. According to the same report, 62% of those businesses do their banking with these larger institutions.

Conversely, small businesses with 99 or fewer employees tend to make up the bulk of business customers at regional banks, community banks, and credit unions. Interestingly, online only banks tend to attract the smallest of small businesses, especially in comparison with the 100+ employee firms.

Take-Away:

To tap into an already receptive audience, community-based financial institutions and regional banks should consider expanding their current marketing outreach to target even more single-employee businesses and perhaps even independent workers.

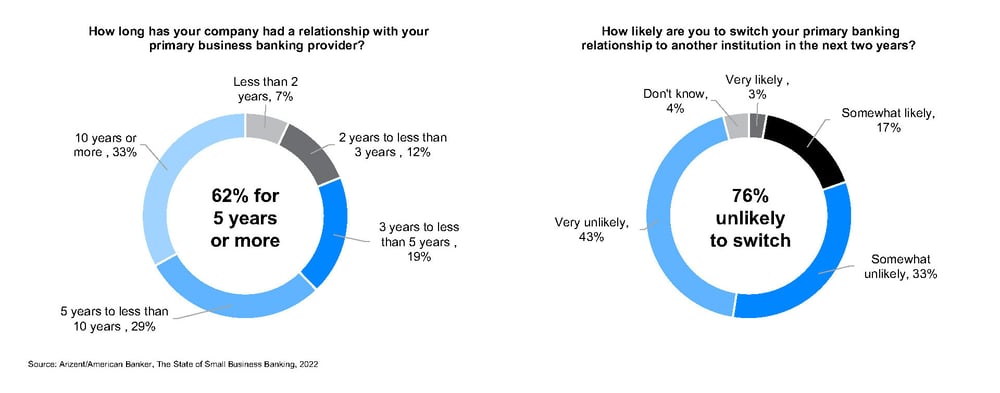

Once a small business settles on a banking relationship, they seldom leave. According to the Arizent report, 62% of small businesses have been banking with the same provider for five years or more. One-third of those respondents have been with their current financial institution for a decade or longer. Moreover, 76% of respondents said that they are unlikely to switch financial institutions; almost half of them said that they are very unlikely to leave.

These are remarkable figures — and reflect a deep-seated trust between the two parties more akin to that of a partnership than to the more typical transactional relationship.

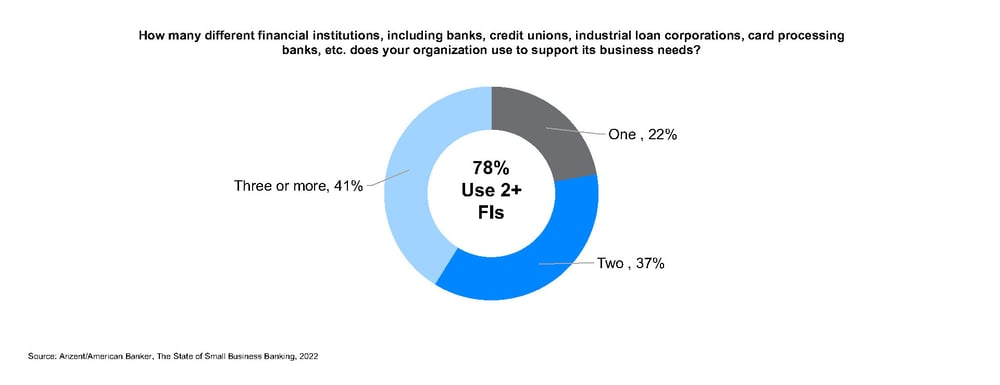

Despite this longevity, one banking provider is rarely enough. When asked how many providers they currently rely on, small business owners overwhelmingly rely on two or more (78%); almost half rely on three or more of providers.

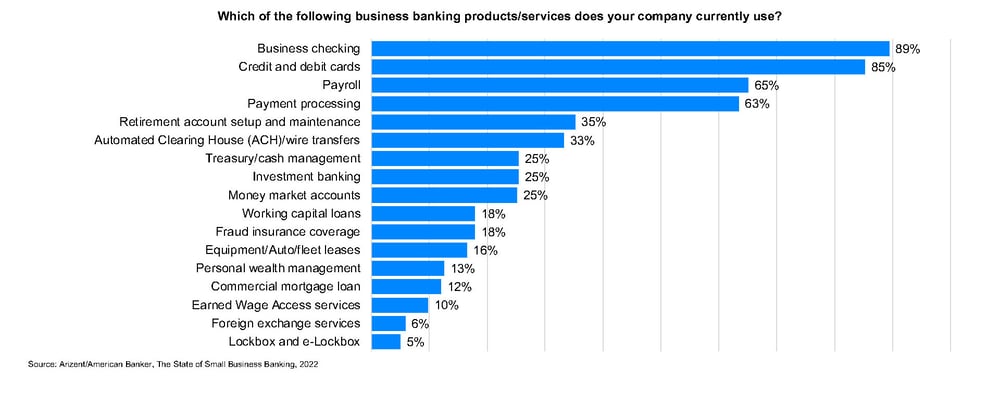

Drilling down, respondents were asked to list the specific products and services they currently use. Overwhelmingly, business owners still pointed to checking as the top product, a necessity that is clearly not going away any time soon. A close second was the need for credit cards and debit cards. Of course, the two work hand-in-hand to provide the business with a quick source for working capital. More than half of respondents also cited a need for payment processing — clearly reflecting an evolving need to accommodate more digital payments.

Small businesses must often rely on more than one banking provider out of necessity, likely to help them accomplish a diverse set of tasks (or jobs) that may include card payment processing, financing, and more.

Take-Away:

Because small businesses must often rely on more than one banking provider to accomplish a diverse set of tasks (or jobs), financial institutions would do well to uncover the specifics of those needs. This demand-side approach could uncover valuable customer insights — leading to improved product offerings that are more closely aligned with their customers’ workflows and challenges.

A growing reliance on third parties when it comes to banking

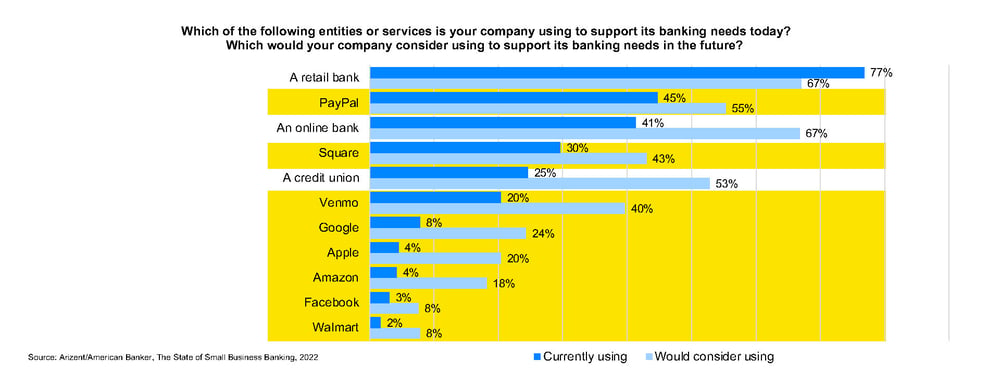

According to the same Arizent report, small businesses are taking a “more expansive view of banking.” We’ve touched on the fact that most small businesses, especially those with 20 or more employees, typically rely on more than one banking provider to support their financial needs. However, as an added wrinkle, a growing number of owners responded that they would consider using “non-bank entities” to support future banking needs.

Of the small businesses surveyed, almost half said that their banking providers include PayPal, and a similar number rely on online banks, such as Discover and American Express or nonbanks such as Chime. In addition, 30% reported that they already partner with Square.

Just as significantly, small businesses that currently rely on traditional banks are weighing the possibility of turning to third-party platforms: more than half of respondents said they would consider using an online bank or PayPal.

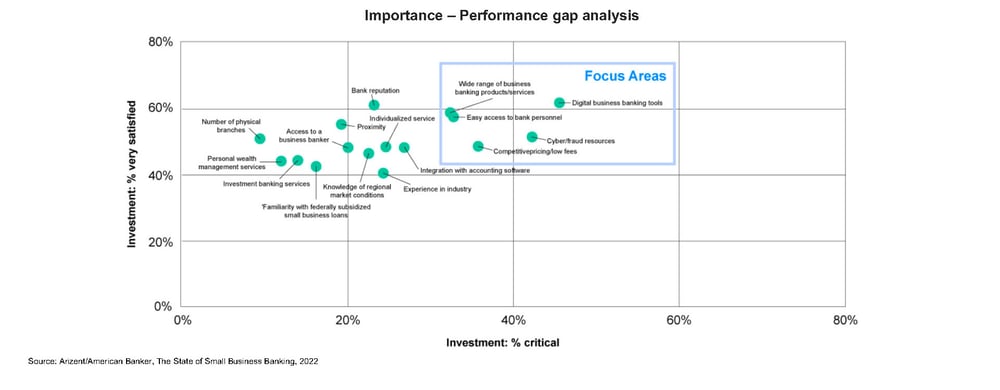

The authors shared a performance gap analysis in the same study, and uncovered a clear area of focus in the right-most columns. These are needs that are both critical to the success of the small business, but that have not been easily satisfied by current providers. Those areas, highlighted by the blue box, include the need for a wide range of business banking products and services, as well as the need for digital business banking tools.

Worth noting: the needs located closer to the bottom of the box have a lower satisfaction rating that hover closer to the 50% mark (e.g., competitive pricing/low fees, cyber/fraud resources, easy access to bank personnel), and could serve as an easy way to attract more customers.

Take-Away:

The continued growth of new businesses — along with their need for new technology and improvements to the customer experience — have sparked an extraordinary opportunity for those financial institutions that are willing to deliver on critical workflow-related products and digital-first services that have not been easily satisfied by current banking providers, including third parties.

The risk of not taking action

Prior to the pandemic, the small business market category represented a $370 billion opportunity for financial institutions, according to Cornerstone Advisors. As we enter 2023, this number will likely surpass the $400 billion mark.

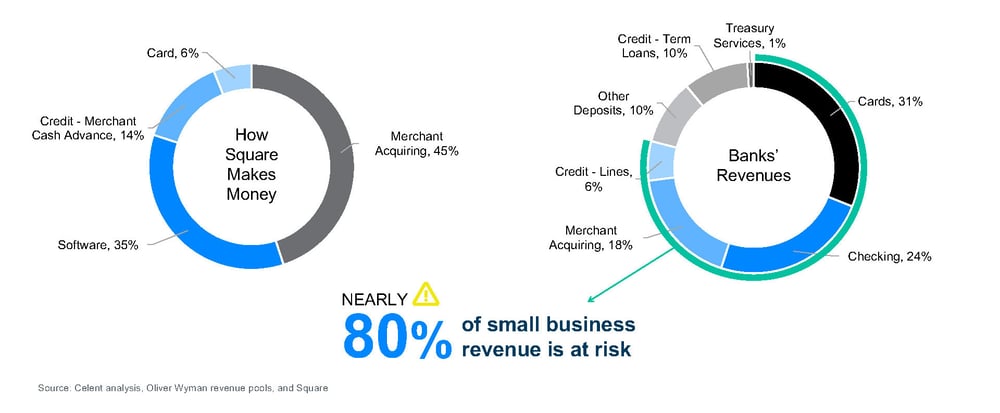

This opportunity has not been lost on third-party app providers, as they continue to target small businesses desperate to find new efficiencies and ways to cut costs, while continuing to attract new customers. As we can see below, Square in particular has been quite successful in diversifying their small business offerings. According to the Arizent report, the third-party giant is now targeting 80% of banks’ revenue by offering products and services like checking and loans — long the purview of banks and credit unions.

Based on research conducted by Autobooks, and shared in the same report, it’s become clear that third-party app providers are succeeding. More specifically, a growing number of existing business customers are relying on third-party apps for their payment acceptance needs — an area that Autobooks tracks closely.

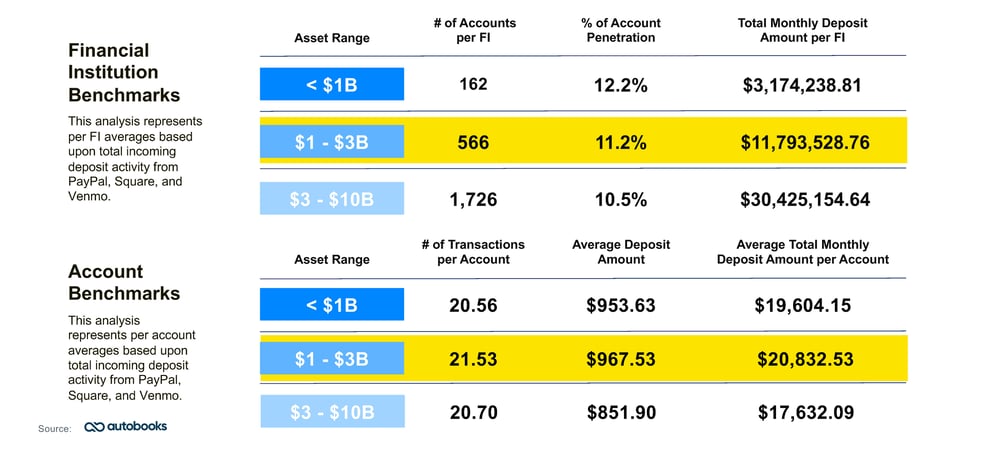

Based on a pool of 113 financial institutions with a total of 529,106 business accounts (over a seven-month window), Autobooks identified almost 45,000 customer accounts connected to the three most popular third-party payment acceptance apps: PayPal, Square, and Venmo. Combined, these customers deposited over $850 million at their institutions — all coming from these third-party competitors.

No matter the size of the financial institution, third-party account penetration hovered between 10.5%-12.2%. Likewise, the number of transactions and deposit amounts were remarkably close amongst these diverse financial institutions.

Take-Away:

As we learned earlier in the report, small businesses are prioritizing technology and customer experience. Significantly, both areas are deeply impacted by digital invoicing and payment acceptance solutions. And just as importantly, third-party providers also happen to excel at effectively delivering and supporting these digital-first products.

A closer look at the three main competitors

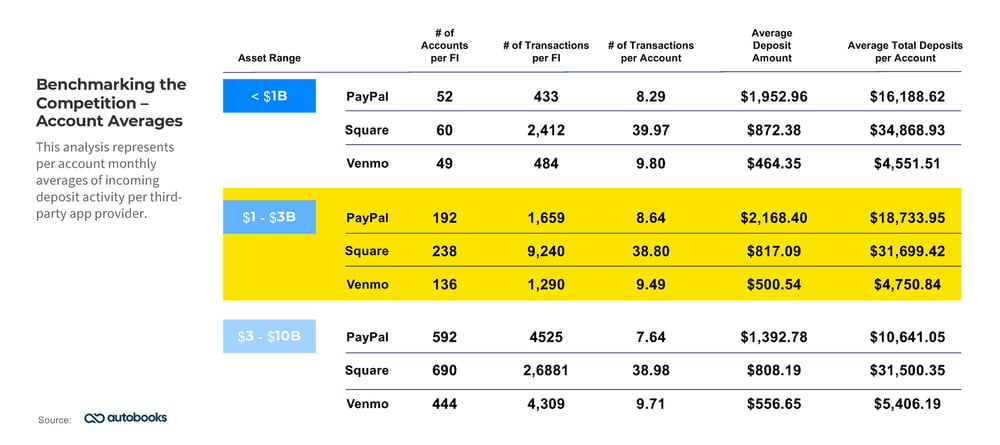

Not surprisingly, Square leads all third parties when it comes to the total number of transactions, per business. This trend holds up, no matter the asset size of the institution. These numbers point to the popularity of the solution, and the fact that Square has become a de-facto tool when it comes to digital invoicing and card payment acceptance.

PayPal users trail Square when it comes to the total number of transactions. However, their average deposit amounts are significantly higher than those of Square or Venmo users, no matter the asset size of the institution. Not only do these higher amounts reflect the fact that PayPal users have a clear need to accept digital payments from customers, but also that these businesses are likely providing higher ticket, one-off services that are ideal for digital-first invoicing and card-not-present solutions.

At first blush, these deposits may be seen to be a win for these financial institutions, regardless of customer behavior. A deposit is a deposit, after all! But digging deeper, these transactions also point to several underlying challenges documented in the report.

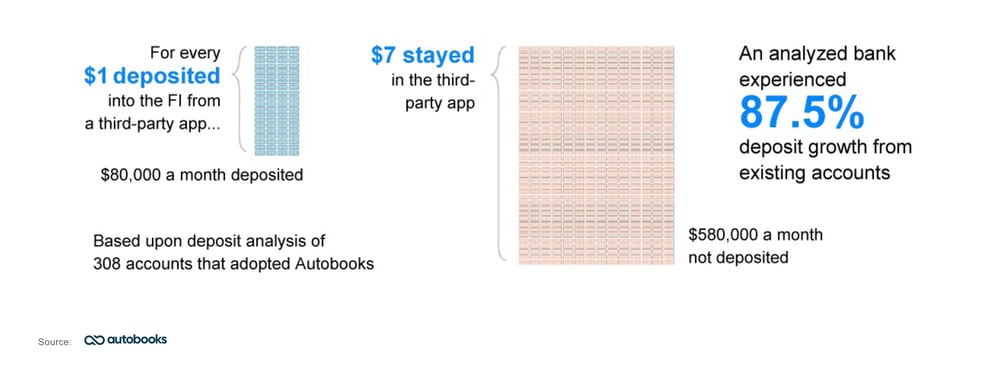

For every $1 deposited into the financial institution from a third-party app, $7 stayed in the third-party app. This is a staggering figure, uncovered from a deposit analysis of 308 accounts that adopted Autobooks at one financial institution.

When those account holders switched from their prior reliance on third-party apps to Autobooks, all of their customer payments went directly into their checking accounts (whereas in the past, these funds were likely held within the virtual wallets offered by these apps). Over several months, the financial institution experienced an 87.5% growth in deposits!

Take-Away:

Not only is it possible to reduce reliance on third-party competition, but financial institutions that do so with the right mix of products and services may unlock significantly higher deposits by becoming the destination for ALL incoming customer payments.

With any challenge, there is an opportunity

It’s clear that business customers are turning to third-party payment acceptance apps to get paid. But what may not be so obvious is that payment acceptance acts much like direct deposit, in that it allows a financial institution or alternative provider to establish trust and build longer-term relationships.

Savvy third-party competitors understand this fact, and leverage payment acceptance as the tip of the spear to penetrate small business relationships. To further unseat the incumbent financial institution — and establish primacy with small business owners — many of these providers have tied-in new integrated financial products that are designed to keep users working inside their digital ecosystems.

Just as importantly, financial institutions are losing out on opportunities to generate non-interest fee income. When a small business owner gets paid through their payment acceptance app, the third-party provider gets paid as well.

Take-Away:

Based on these challenges, the solution seems clear. Why not take a page from third-party competitors and offer small business customers the digital payment acceptance capabilities they so desperately need?

Autobooks can help

Autobooks discovered that 95% of digital invoices sent by users are paid within five days, reducing days sales outstanding, which is critical for any business owner. The importance of getting paid — and promptly — cannot be overstated. A U.S. Bank study found that the reason small businesses fail overwhelmingly has to do with critical cash flow issues. As a matter of fact, a staggering 82% of SMBs fail for this very reason.

With Autobooks, a financial institution is guaranteed that all payments are deposited into a small business’s checking account. Businesses and nonprofits can self-enroll in Autobooks directly inside online and mobile banking — and promptly begin to accept card and ACH payments as well as send invoices and payments.

There is no need for a business owner to rely on an outside platform for receivables — these critical transactions are handled natively within the financial institution’s digital banking channels. The financial institution is able to monetize on those payments and see significant growth in business deposits, especially over time.

You may also like