Third-party activity inside your financial institution: Looking at the data

| In the fifth session of Autobooks ACCELERATE, Derik Sutton touches on the small business market — specifically how business customers have turned to third-party competitors to overcome cash flow challenges, and then how those same companies are able to leverage that initial foot in the door to ultimately disintermediate your financial institution. |

Download the recordings and various resources from ACCELERATE 2022 and make an immediate impact on your financial institution.

Download the recordings and various resources from ACCELERATE 2022 and make an immediate impact on your financial institution.

The following conversation was edited for clarity and brevity.

Business customer needs are changing

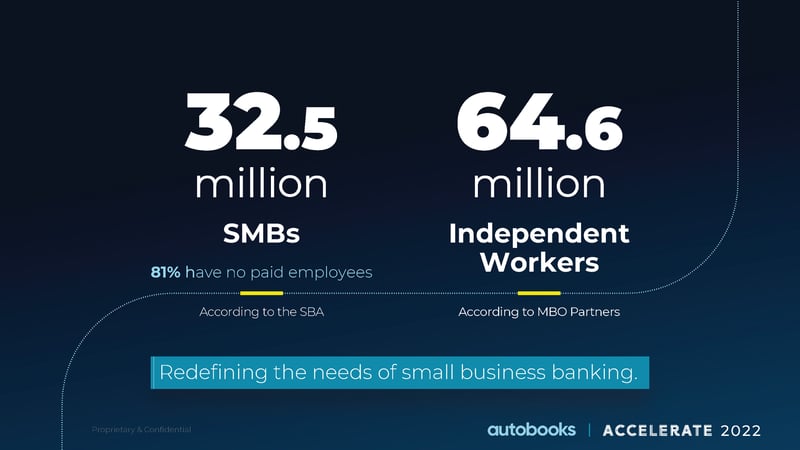

Derik Sutton: We've got two numbers we always like to focus on: there’s about 32.5 million small businesses, according to the SBA. 81% of them do not have employees, so I always like to mention that because you know you'll commonly hear that 32 million number, but the misconception is that all businesses are thought of in terms of products like treasury management or cash management. But the reality is that those products may be great for larger organizations, but they may not always be a good fit for the typical small businesses that are really in need of simple tools.

And so when it comes to looking at their needs to accept payments from people, what you're finding is this: a shift away from accepting cash and check in person to accepting online and in-app payments.

Based on a Visa survey and study done at the beginning of this year, 73% of business owners said new forms of digital payments are fundamental to their growth moving forward. In addition, 59% of those surveyed said they plan to shift to only digital payments within the next 2 years, or are already cashless.

Third-party app providers are targeting banks’ revenues

Derik Sutton: As businesses are kind of reaching for, or in need of digital forms of payments in-app or online, they're starting to have to turn to products like Square. As soon as a business owner downloads their app, Square starts to monetize that relationship. That means they begin to compete with how your financial institution also makes money from that customer.

Basically, every time you see a transaction coming in from Square, PayPal, or Venmo, you have to think about that as a competitive threat to the relationship you have with that business owner, and a loss of revenue potential that you have with that same business owner.

Payment proliferation causes businesses major headaches

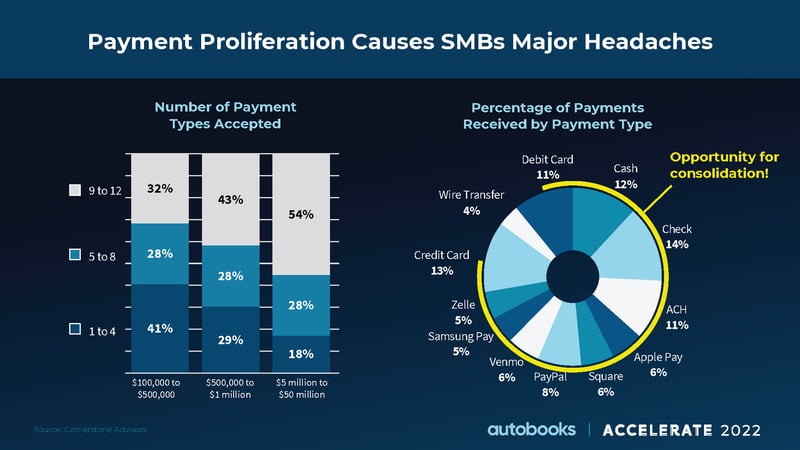

Derik Sutton: We did a report with Cornerstone Advisors a couple of years ago, and what they found was that businesses are really stretched out with the ways that they must accept payment, mainly because they're reacting to customers, saying, “Hey, I want to pay you this way. I want to pay you that way.” And so business owners are having to accommodate a plethora of payment types, and over time it becomes overwhelming for them.

You see 11% accepting debit cards, 12% doing cash, 14% check, and so on. When you're a business owner and you're struggling with cash flow, and now you have multiple ways that you're accepting payments and money sitting inside third-party apps and platforms, and it may or may not be fully connected back into your financial institution. You can see that it becomes a very inefficient process, and it becomes a problem.

By partnering with you your financial institution, because you support cash and check capabilities, Autobooks can start to help those businesses consolidate down the way that they get paid, so it's much simpler for them — and we can start to move away from multiple ways of getting paid.

The Autobooks Small Business Data Report

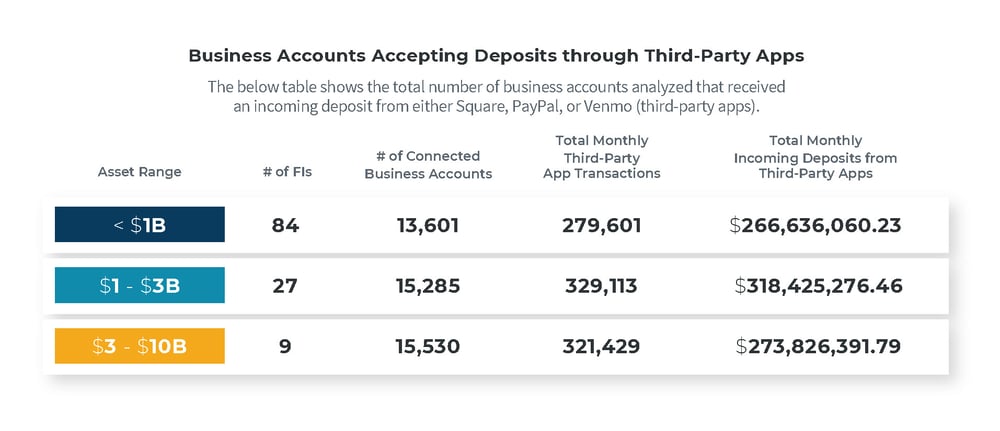

Derik Sutton: To illustrate what is happening with third-party competitors in the small business space, we recently did a report where we evaluated a whole growing number of financial institutions transactions that we've onboarded, and we wanted to quantify the problem. And this is what we found:

So earlier this year we evaluated 113 financial institutions. We looked at almost 530,000 business accounts. When we did the evaluation, we looked at about 7 months of data.

We saw thousands of accounts connected to these competitors, a lot of transactions and hundreds, literally hundreds of millions of dollars of incoming deposits coming in.

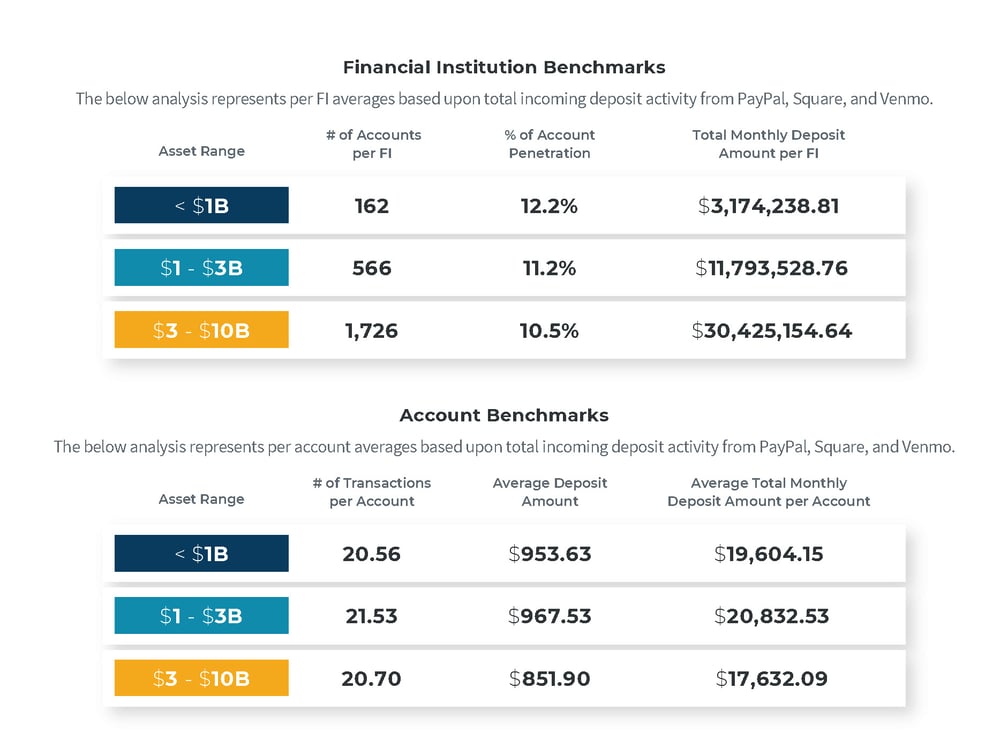

So now let's break it down — make it a little bit more understandable about how that relates to your organization. So for a financial institution less than $1 billion in assets, that we found on average was 162 accounts connected to just PayPal, Square, and Venmo.

That's about 12.2% penetration, and month-over-month incoming was about $3 million dollars of incoming deposits. When you move up to the $1-$3-billion-dollar range, you're looking at almost $12 million dollars in monthly deposits. You can see the other institution sizes and breakdowns in the same slide.

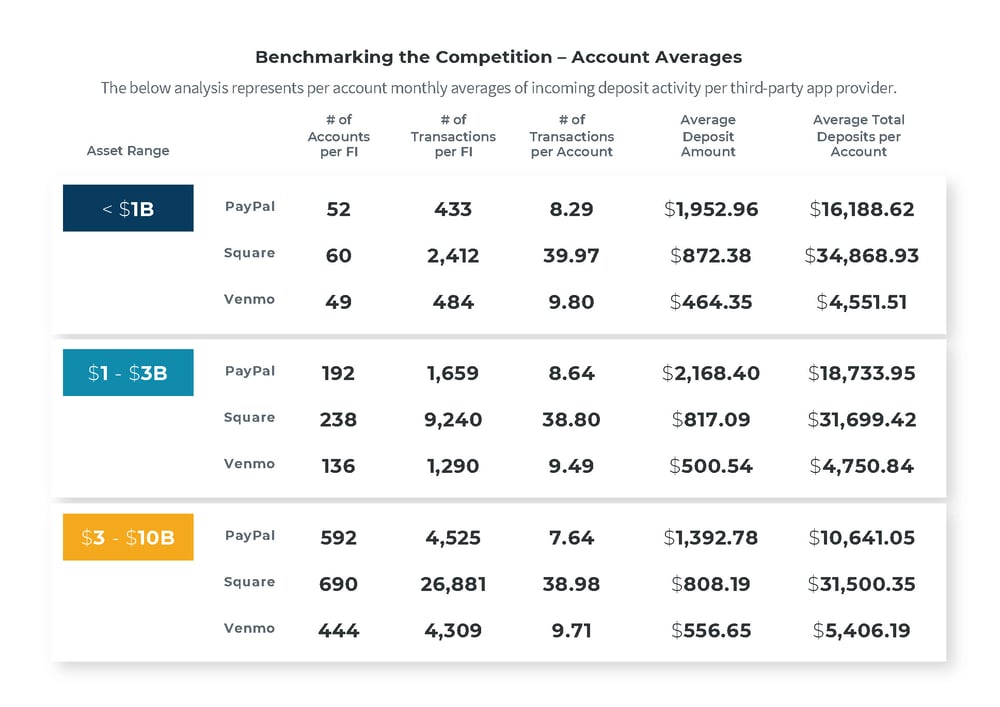

Furthermore, we broke down each of the individual platforms in their data to see how the numbers play out.

So, focused on the middle section, what we found here is that more people are connected to Square. You get a lot more transactions on Square. So think about that day-to-day; it breaks down to about $817.09 on average, meaning people are using Square for lots of transactions — some are likely low and some are high.

PayPal is really kind of the theme that stood out to me. We see fewer transactions than Square, but with much higher ticket items. And then Venmo was the one that really stood out to me on the business side. Even just $500 a month on the average ticket really stood out to me because I expected them to be lower. I didn't expect them to be connected to as many business accounts as they were. I think what you really have to think about is that they provide a very simple use case of, “I need to request money from somebody, and I want them to pay me right now.”

Want to learn more about third-party competitor activity in the Autobooks Small Business Data Report? |

You may also like

-

Small Business Banking | Supporting Small Business | Events

Autobooks Named to the 2021 CB Insights Fintech 250 List of Top Fintech Startups

-

Transforming Digital | Gaining Perspective

Embedded fintech: The new product future for financial institutions

-

Transforming Digital | Growing Revenue

Community Choice and 4Front Credit Unions Share How They are Growing Deposits