Jobs to Be Done and the new features that help small business owners

|

In the second session of Autobooks ACCELERATE, Chris Spiek goes in-depth into how Autobooks approaches product development as a company, and why Jobs to Be Done is such a crucial component. Spiek also touches on some new features that are built specifically to help small business owners overcome challenges and make progress. |

Download the recordings and various resources from ACCELERATE 2022 and make an immediate impact on your financial institution.

Download the recordings and various resources from ACCELERATE 2022 and make an immediate impact on your financial institution.

The following conversation was edited for clarity and brevity.

A background in demand-side product development

Chris Spiek: I got my start building software. I quickly came to the realization that launching SaaS applications and digital products just wasn't going to be any fun if no one adopted them. So, I took a left turn very early on and basically set down a path to understand what drives consumers to purchase and embrace some products and ignore others.

Through that journey I met a gentleman named Clayton Christensen, famous for writing The Innovator’s Dilemma and developing Disruptive Innovation theory. As Clayton was laying out his theory, he came upon this notion that he called Jobs to Be Done. This is the idea that as customers go about their lives, they encounter problems along the way that cause them to struggle — consequently, they hire products to help them overcome these struggles and make progress in their lives.

I ended up dedicating about a decade of my career working with Clay and another gentleman named Bob Moesta to formalize and popularize this product development methodology that came to be known as Jobs to Be Done.

Before Clay passed away, he wrote a book about the work that that we had done together. It's a great jumping off point if you're just getting started, and essentially provides us with a framework for what we call demand side product development.

A passion for the consumer and their moment of struggle

Chris Spiek: So as much as I love programming and developing product, my other passion is really focusing on consumers — in this case small business owners — and trying to understand more deeply what motivates them to make a purchase. Then I translate that into asking, how do we deliver value through the products that we create?

Essentially, the way that you deploy Jobs to Be Done is through one-on-one, one-hour-long interviews with decision makers. What we do through these interviews is basically have a structured conversation about why they made the decision to buy. What we do in the case of Autobooks is ask them why they “hired” us for the job at hand.

In other words, tell us the steps that led up to buying and using Autobooks — and take us back to the first moment that you started to realize that you might need to shop for something new, and walk us through that entire journey. The part of the story that we're focused on is essentially what we call the “struggle.”

It's not interesting for us to talk about Autobooks and all the features, and why you love it, or why you hate it, because that's sort of the end of the story. What I'm interested in is: what happened in your business that caused you to say out of all the things that I could focus on today, tomorrow, or the next week, I need to figure out this thing. I’ve got to figure out how to send an invoice, how to get paid, how to organize my books. And I’m actually willing, as a consumer or small business owner, to invest time in figuring out this this problem. And what happens is if you have conversations that really focus on that moment in the consumer story you learn about causality.

You'll learn about what pressures they're feeling in their day-to-day lives that's causing them to put energy into shopping and re-reading reviews and talking to their friends. And if you analyze that data effectively, as a company, you're able to come up with opportunities in which you can develop products to satisfy those customers.

The reality is, if you think about yourself as a consumer, there are things that you're prioritizing, and things that you're deprioritizing. And it's just the things at the very top of that list that you're thinking about. Those are the messages that are getting through to you. So we’ve got to understand what's causing people to struggle.

The four jobs of small business owners

Chris Spiek: We essentially get one small business owner in the room at a time. We talk for about an hour and basically get their story. And then we do what we call clustering on causality. We interview people from very different backgrounds and very different industries, but the things that they have in common is that they needed to make a change, and we cluster those groups together. We call that a Job to Be Done. We're going to share some of the jobs that we arrived at through this research.

I think it's important that we get into the details here, because the thing that I hear most often from our financial institution partners goes something to the effect of, “I'm partnering with Autobooks, and I’m trusting that you guys are doing your homework, and that you guys are the subject matter experts on small business.”

That’s why it's important to share some details about the process, and the fact that we have a methodology along with a decade of experience on applying this method, and really spending intimate time with small business owners, understanding what they're looking for. That way we can make sure that we build the best products that we can.

I'm going to walk you through the four reasons (or Jobs to Be Done) that we've uncovered when small business owners adopt Autobooks.

Job One:

Add a simple and trackable way to get paid to my existing system

The first job that we've discovered that people hire Autobooks for is to add a simple and trackable way to get paid into an existing system. The stories that we hear are: My existing system is very complex. I'm starting to have things fall through the cracks. So people owe me money. I've got this Excel spreadsheet where I keep track of everybody who's paid me, and who didn't pay. I've got Word documents where I'm sending out invoices over email, or I'm stuffing them in envelopes. Some people are paying me through Square and PayPal. Some people are paying me like when they show up. I plug in my little dongle, and they swipe. But there's money all over the place, and I’m never sure if people are paying me, or if they're not. This is a situation where a lot of times it goes on for weeks or months. And the way they describe it is, “If I was a better business owner, I would have this thing buttoned up.”

We address this job in many ways. We have email campaigns where we communicate this simple fact: When you send an invoice through Autobooks, payments go right into your business checking account. There’re no moving funds around or losing track of things. Autobooks is able to come in and say, look, send the invoice, get paid directly into the DDA. Don't leave money all over the place.

And then we've got a dashboard. If it's red, they owe you money. If it's green, they paid the invoice. We can wipe out all of this uncertainty. Kill the Word document, kill the Excel spreadsheet. Let's get rid of that. And let's really sort of centralize things in in one place, inside a financial institution’s online and mobile banking.

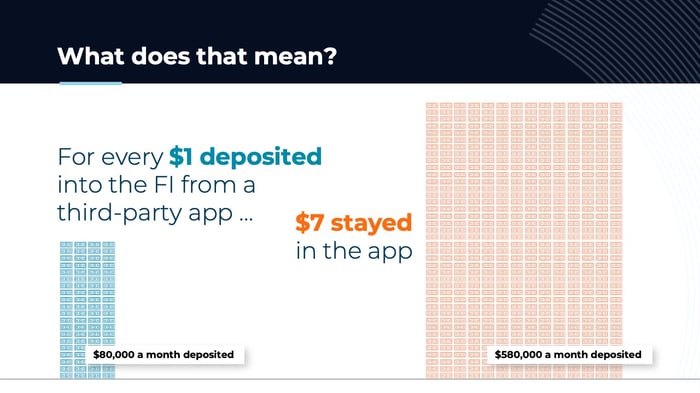

So the real impact that that this has on us and on the financial institutions, you guys, that partner with us is on the DDA, and the balances in the checking account. What our analysis shows is that for every dollar deposited from PayPal, from Square, from Stripe, there's $7 that stays in their respective app.

The majority of these people are leaving their money inside the PayPal account, the Square account. After all, they've got the debit card. They can spend it right out of that account — and frankly, it's a real threat to the financial institution.

Job Two:

Help me get back to offering credit cards to my customers

The second job that we're going to get into is: help me get back to offering credit cards to my customers. We talked to small business owners, and they say, I took cash and checks for a long time. My customer started asking me, can I pay by card? They start to accept card payments through a third-party app. So now they’re using Square, PayPal, to get paid into their accounts, but they end up getting burned.

Often, the way they get burned is that these apps end up holding their money. Here’s what we hear, paraphrasing:

“A lot of times I had my customer on the line, when I'm calling into their support, saying, ‘Why are you holding? I did the job. I did the roof. They paid me my 15 grand. You allowed the payment to come into PayPal. You didn't bounce the payment, but now I’m in some fraud department, and I need the money to pay my guys, and you're not releasing it.’ I thought I was supposed to trust you guys. I'm paying a lot of times. I'm paying you to do this service. And now I figure out that I can't trust you because you're locking up my money.”

And so what we find is, these owners end up going back to cash and check. Then they start searching again for another solution... “How can I find something where I can provide my customer with the experience that they want? They want the sky miles. They want the United Airlines. They want to be able to swipe. But I don't want to get burned, and you know, burn my team members because I can't pay them.”

But we know that many of them still trust their financial institution. That’s why it’s incumbent that you message them at the right time, “We know you might have been in a bad situation with other providers, but your bank, whom you trust, has a solution that is easy to sign up. We're going to automatically underwrite you, and we're going to provide you with an ability to take credit cards again without the risk of a third party holding on to your funds.”

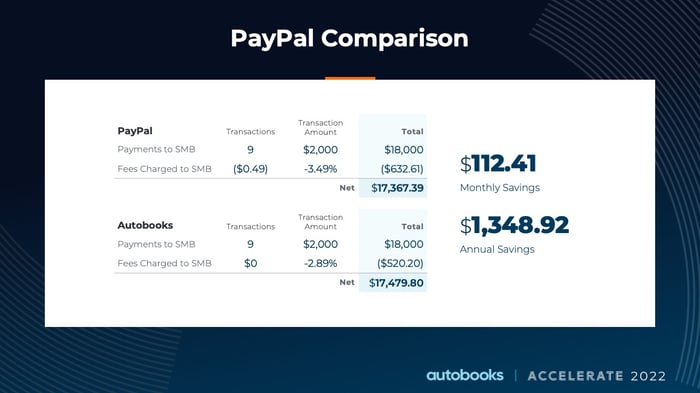

It takes a lot of the anxiety out of making that switch right? Now they're able to go from just cash or check payments into digital payments that are landing directly into their account. And the other benefit here is from a rate perspective, right? So here we have some analysis of the fees charged by the third-party providers. If we're doing around $17,000 a month, it’s over $100 per month saved — and over $1,300 in annual savings getting paid quickly and getting paid directly into that into that DDA.

Job Three:

Make it easy to get started with invoicing and accepting payments

The third job that we'll go through here is around new businesses and their journey as they're starting off. Their business is again wrestling down the complexity that creeps in. Oftentimes we hear stories where I got my bank account. I got my website. Now I’m looking at all the software packages that have been built up to serve whatever vertical that I’m getting into.

The story I always tell is an interview that we did around a husband and wife who bought a public storage facility. They're running it as a side hustle. Their plan is to acquire and run multiple facilities.

And they say, “Wow, I never knew that there were all these software providers that offered software specifically for this industry. But, by God, now I'm paying hundreds of dollars a month to access it. All these charts and graphs. I don't need all that stuff. How do I get the people who are renting on auto pay, so that this thing can run itself?”

Lucky for them, at the time they’re opening their business account, sitting across from their banker, they hear, “Don't worry about all that stuff. What you need is a way to accept credit cards and send an invoice, and we've got that built directly into the checking account that you're opening to start your business.” When they hear that from their banker — that’s powerful.

So again, it’s about keeping complexity out of it. I’ve got a million things on my mind as I’m starting my business, learning some sophisticated software package is not one of the things that I need on my plate. As I’m spinning up my product and my marketing and things like that, just keep it simple. Make it easy to get started with invoicing and accepting payments.

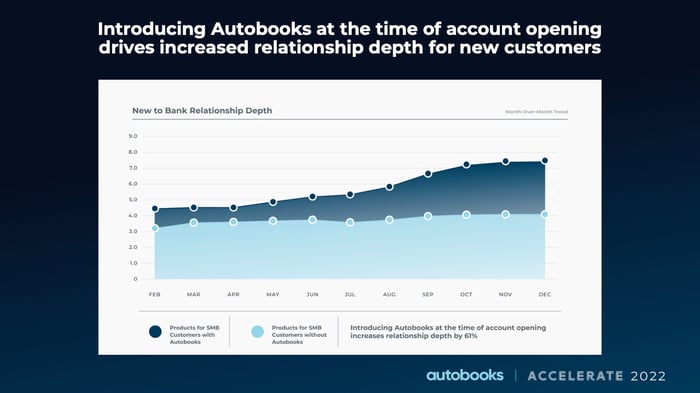

Then there’s the benefit to your financial institution. Through our research, we’ve uncovered a striking fact: Autobooks users tend to go deeper with their institutions. They end up paying for more products and services over time — almost double than a customer who doesn’t rely on Autobooks.

Job Four:

I’m overwhelmed; make invoicing and accepting payments simpler

This fourth job conveys a situation that I refer to as the train hitting the business owner. It goes something like this:

“I've been running my business forever. I launched a new product, and it took off. Then my partner resigned, and they handled bookkeeping the entire time. We landed a huge client, and I've got to get this house in order.” Job 4 comes out of nowhere and just collides with them, and all of a sudden they get shaken up, and they say this business is changing. I need to get this house in order. My old way of getting paid is just not working.

I interviewed one woman. Her partner had left the business. He was creating invoices in Photoshop, and she's saying, “This guy's got his process. He's been doing it for 10 years. I've never seen anything so convoluted. I finally figured it out. But then there’s the first invoice I sent out. They're late, so I’ve got to open Photoshop again. I’ve got to change the date. I’ve got to add a late fee. This process is killing me."

Then she logs into online banking. She clicks the button that says, ‘Send an invoice’ inside online banking. It's got a template. She drops her logo in, she adds sales tax. She has the products and line items, and she's out the door. With Autobooks, we've been able to simplify somebody’s process dramatically.

These are people in true pain. They're saying, “I’ve got to run the business. I’ve got to grow the business. And this is really causing me stress. Just give me something where I can do digital payments — collect them online without having to interact with people face-to-face.

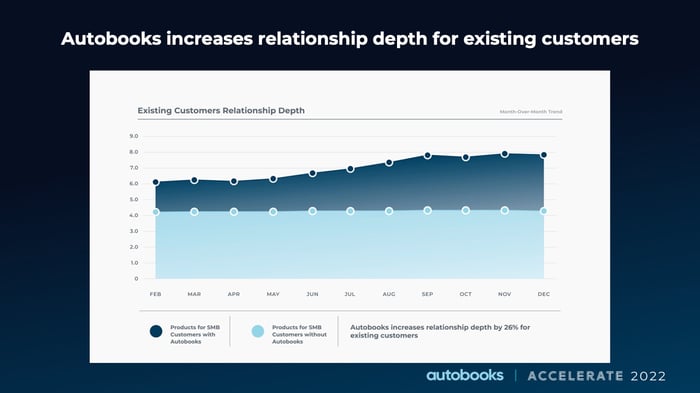

Here’s a similar chart, but on existing customers. We talked about Job 3, which was the person starting the new business looking for simplicity. This is a customer that's been with the financial institution for some time. We see a similar, obviously not as pronounced, but 20 percent increase in relationship depth.

We attribute it all to that frequency of digital banking. They’re logging in multiple times a day, creating invoices. These customers are naturally exposed to other products, and they begin to lean on their financial institution to solve more of their challenges as they develop trust.

New product updates aligned with the four jobs

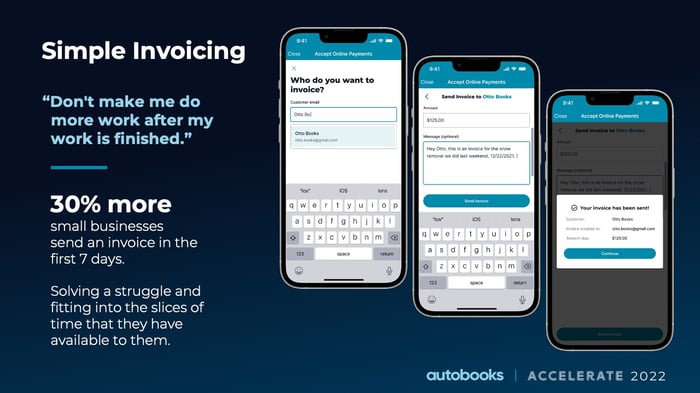

Chris Spiek: The first update we’ll cover here is called simple invoicing. This is something we launched about three weeks ago. This is a mobile-only offering. Your customers logging into their digital channels on their mobile device can now send very simple invoices. You can basically count two fields here to get an invoice out the door. So again, what we were hearing from customers that prompted this update was, “Don’t make me do more work filling out the invoice. I want to send it and be done.”

Our response here was, we're going to reduce the number of fields that we offer now. This is very, very simple. You're going to type in a customer email, whether they exist or not. If they exist, we're going to find it. If not, we're adding them. Then they type in an amount and a message, and get that invoice out the door.

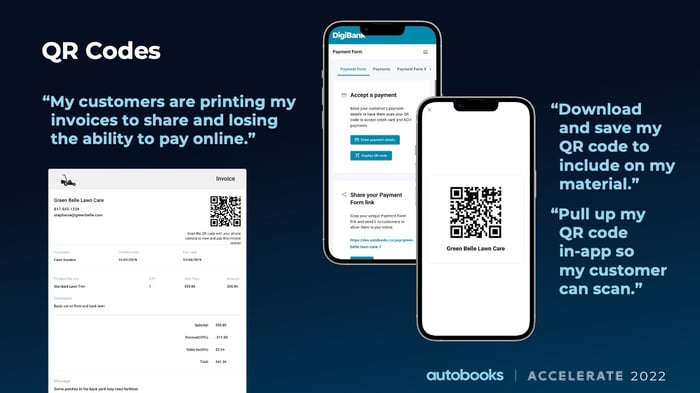

The second product update we'll talk about here was also a recent launch. The struggle that we heard was, “My customers want to pay online. I'm sending out the invoices, and we've got a little link to pay now. My customer that receives that invoice is hitting print on the invoice, and sharing around to the folks in the office, and then they're mailing me a check. But the promise that you guys made was I'm going to get paid digitally. I'm going to get paid faster, but it's not happening.”

In response to this need, we added a QR code to every invoice. So now even if you hit print on that invoice, you can still quickly scan that QR code, make the payment online, file the invoice away, and mark it paid.

We also added a QR code to the payment form. Now a small business owner can share their unique code on their screen when accepting in-person payments, or just save it and print it anywhere they need to get paid. There are many use cases for a QR code — we’re just skimming the surface here.

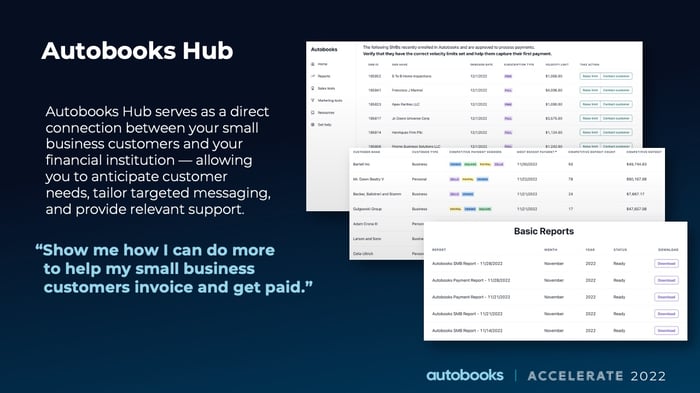

The last update we’ll touch on comes back to our investment in the small business space. To this end, we’ve dedicated a lot of time and energy to the Autobooks Hub. The Hub is basically where our banking partners go to access data related to their small business customer base. It serves as a direct connection between small business customers and their financial institution — allowing the institution to anticipate customer needs and take action with tailored messaging and contextually-relevant support.

We want to ensure that your bank has the information it needs to identify third-party activity inside your accounts, and be able to do something about it with a variety of tools at your disposal, such as real-time messaging, email campaigns, and more.

You may also like